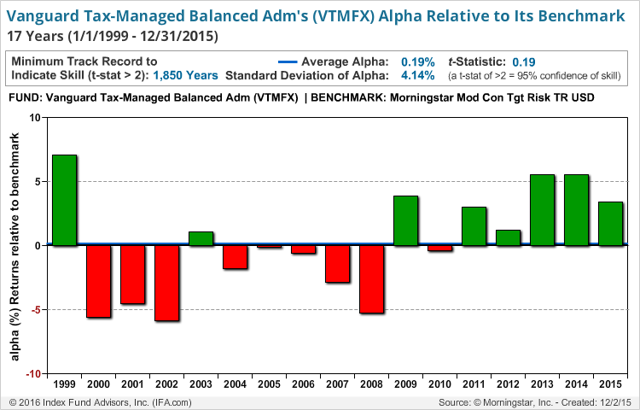

vanguard tax managed balanced fund morningstar

3 For the 10-year period ended June 30 2020 26 of 34 Vanguard bond index funds 16 of 17 Vanguard balanced index funds and 85 of 103 Vanguard stock index fundsfor a total of 127 of 154 Vanguard index fundsoutperformed their Lipper peer-group averages. Bonds the Bloomberg US.

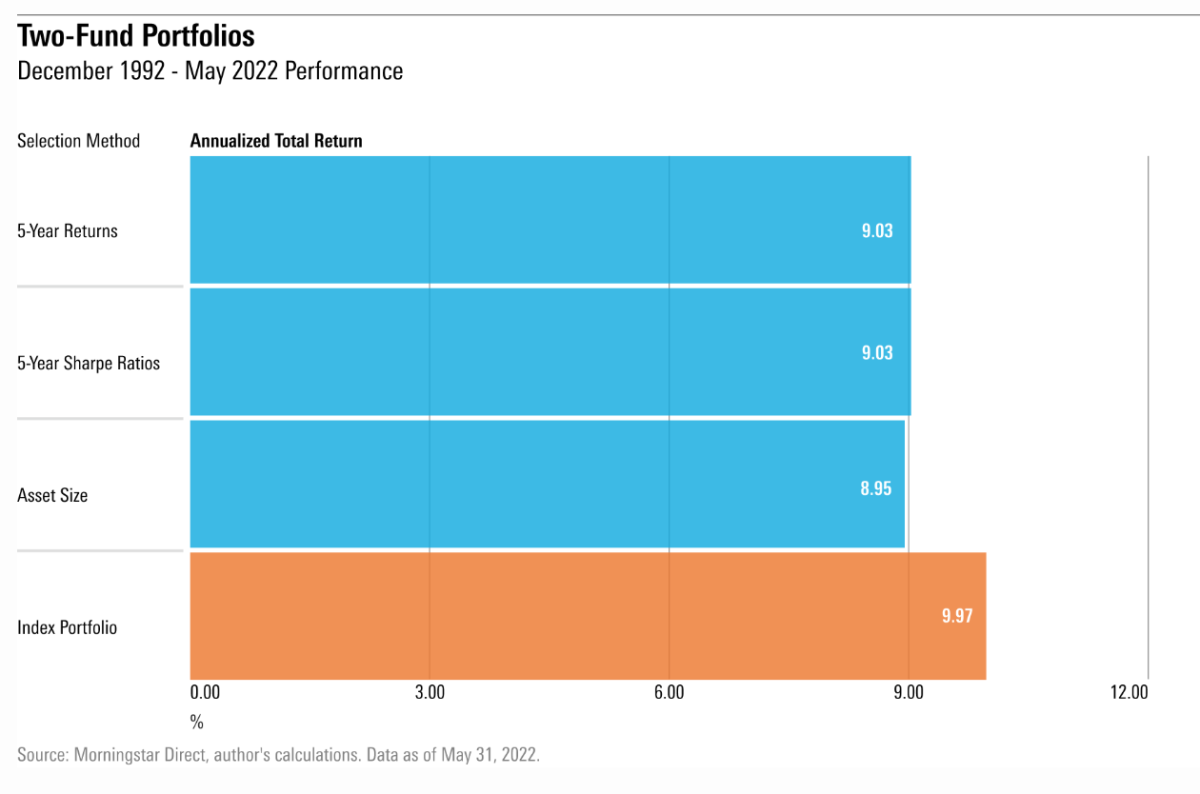

Enhancing Equity Index Mutual Fund Returns Using Cost And Morningstar Ratings Information The Journal Of Investing

Vanguards Wellington launched in 1929 and is the oldest US.

. Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC. Only funds with a minimum 10-year history were included in the. 4 For the 10-year period ended December 31 2020 81 of 93 Vanguard actively managed funds outperformed their peer-group averages.

The Wellington Fund Admiral Shares fund symbol VWENX is a mutual fund within the Vanguard Mutual Funds family. Vanguard and Morningstar Inc as of 6302022. Derived by applying the funds target asset allocation to the results of the following benchmarks.

The portfolio is enormous with close to 750 stocks and the fund has 202 billion in total assets which makes Vanguard Explorer the biggest actively managed small-company fund in the country. Vanguard Balanced Index Fund. See Vanguard Balanced Index Fund performance holdings fees risk and other data from Morningstar SP and others.

Most annual tax statements from managed and trust funds use 50 CGT rate. For international stocks the FTSE Global All Cap ex US Index. Results will vary for other time periods.

For international stocks the FTSE Global All Cap ex US Index. He began his career with consulting firm McKinsey and eventually. While index providers often emphasize that they are for-profit organizations index providers have the ability to act as reluctant regulators when determining which companies.

As of January 2022 the fund has an average 3-year pre-tax annualized return of 933 763 for the last five years and 729 over 10 yearsresults that have consistently earned it a four- or. Global Wellington Fund and Global Wellesley Income Fund. Born in 1943 in Massachusetts Mullin earned his MBA from Harvard.

Brokerage assets are held by Vanguard Brokerage Services a division of Vanguard Marketing Corporation member FINRA and SIPC. Etfs Morningstar Global Technology Etf. Vanguard which manages 800 billion in multi-asset class portfolios has appointed long-time investment advisory partner Wellington Management Company LLP to manage the new funds.

Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles. As of October 18 2022 the fund has assets totaling almost 3092. Who has been with Vanguard since 1998 has co-managed the fund since.

They are traded on stock exchanges. You have the option to choose between the 13 or 50 CGT. Vanguard today launched two actively managed global balanced funds.

Vanguard and Morningstar Inc as of December 31 2021. A former CEO and chairman of Delta Airlines. Meanwhile the median tax-cost ratio of that same group of funds.

ETFs are similar in many ways to mutual funds except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at days end. Aggregate Float Adjusted Index. The Vanguard Tax-Managed Balanced Fund Admiral Shares VTMFX The funds asset allocation is around 48 in stocks and 52 in bonds.

Vanguard Tax-Managed Balanced Fund Admiral Shares since 6282013 Vanguard Intermediate-Term Tax-Exempt Fund Admiral Shares since 6282013. Stocks the CRSP US. For international bonds the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index Hedged.

Derived by applying the funds target asset allocation to the results of the following benchmarks. See Vanguard Energy Fund VGENX mutual fund ratings from all the top fund analysts in one place. Aggregate Float Adjusted Index.

See Vanguard Energy Fund performance holdings fees risk and other data from Morningstar SP. Results will vary for other time periods. Vanguard High Growth Index Fund.

The bond portfolio consists of federally tax-exempt municipal bonds. Funds in this category invest in real estate primarily via REITs. Generally these hybrid funds stick to a relatively fixed.

For additional financial information on Vanguard Marketing Corporation see its Statement of Financial Condition. Since its inception in 1994 the fund has not distributed a capital gain and its 10-year tax-cost ratio of 046 is significantly below the allocation30 to 50 equity Morningstar Category. An exchange-traded fund ETF is a type of investment fund and exchange-traded product ie.

A balanced fund combines a stock component a bond component and sometimes a money market component in a single portfolio. For international bonds the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index Hedged. The typical large-blend fund in Morningstars database posted an annualized return of 104 over the decade ended September 2022.

There is one other fund which has a pratically identical return profile to VWENX which is VWELX a mutual fund from Vanguard Mutual Funds. Bonds the Bloomberg US. An index fund also index tracker is a mutual fund or exchange-traded fund ETF designed to follow certain preset rules so that the fund can track a specified basket of underlying investments.

Stocks the CRSP US. Vanguard Growth Index Fund. The fund falls into Morningstars real estate category.

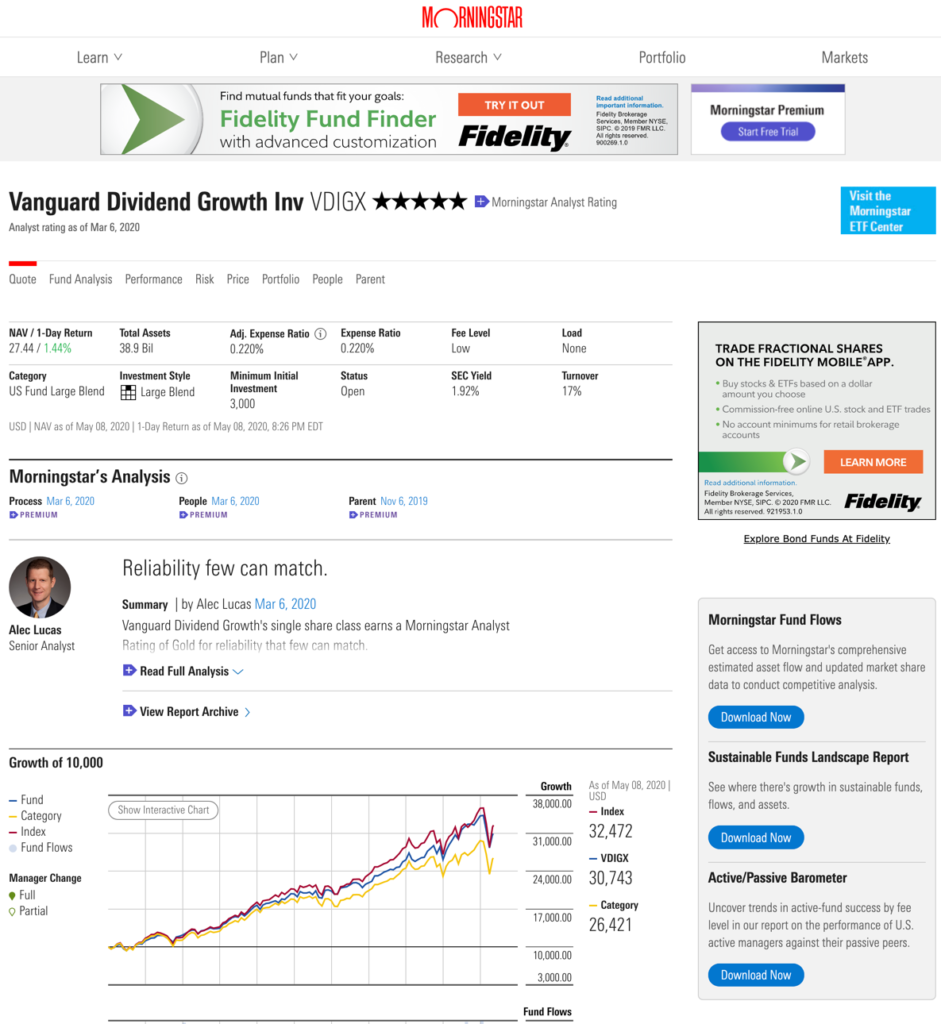

Feb 01 2022 The fund has been around since 1970 and is a holdover from when Vanguard purchased Wellington. A funds Morningstar Rating is a quantitative assessment of a funds past performance that accounts for both risk and return with funds earning between 1 and 5 stars. Investors striving to beat the market with an actively managed balanced fund and a long track record need to look no further.

Morningstar Archives The Evidence Based Investor

Vanguard S Active Funds A Deeper Look At The Performance Seeking Alpha

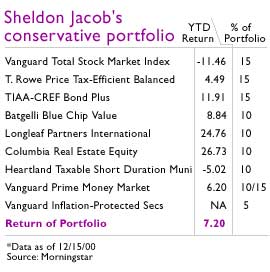

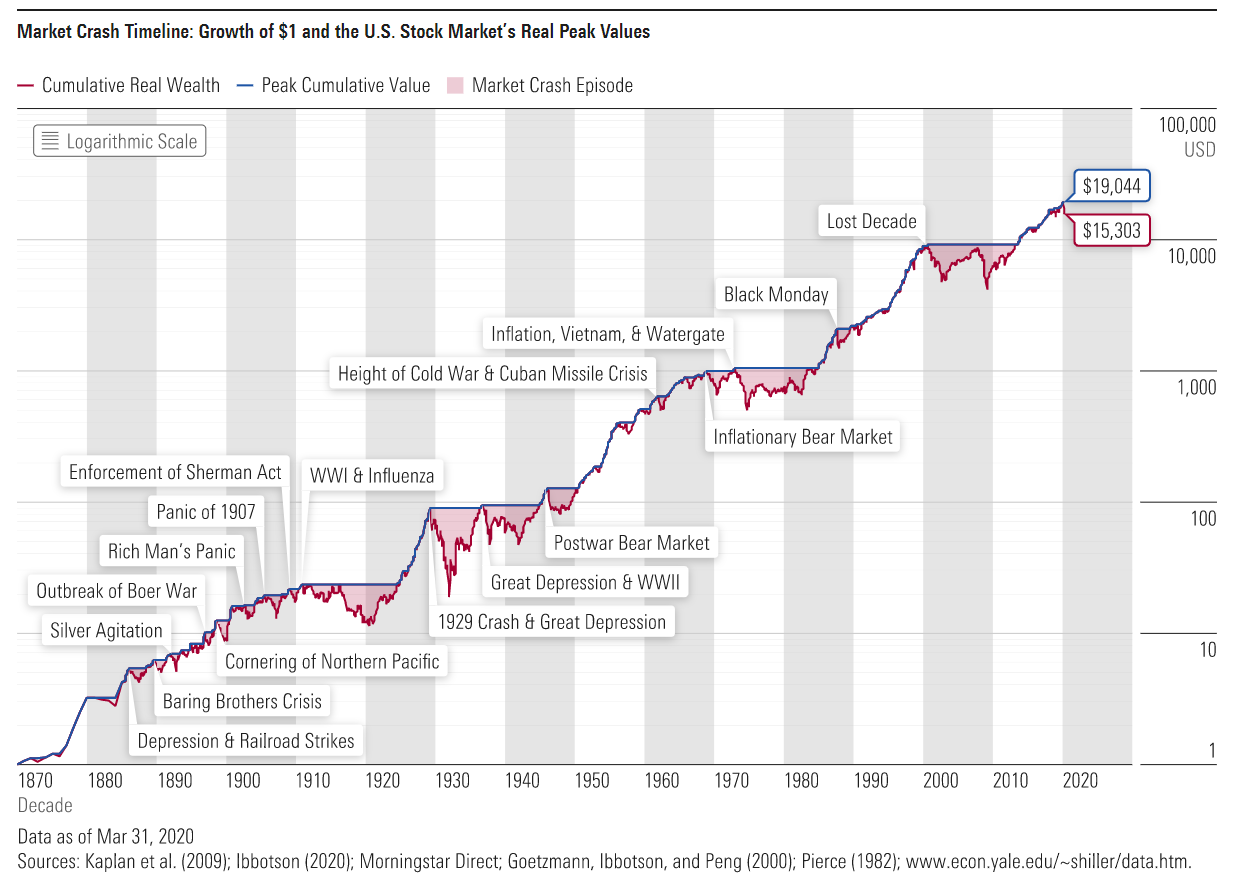

How Conservative Moderate And Aggressive Portfolios Survived The Volatile Year Dec 31 2000

Enhancing Equity Index Mutual Fund Returns Using Cost And Morningstar Ratings Information The Journal Of Investing

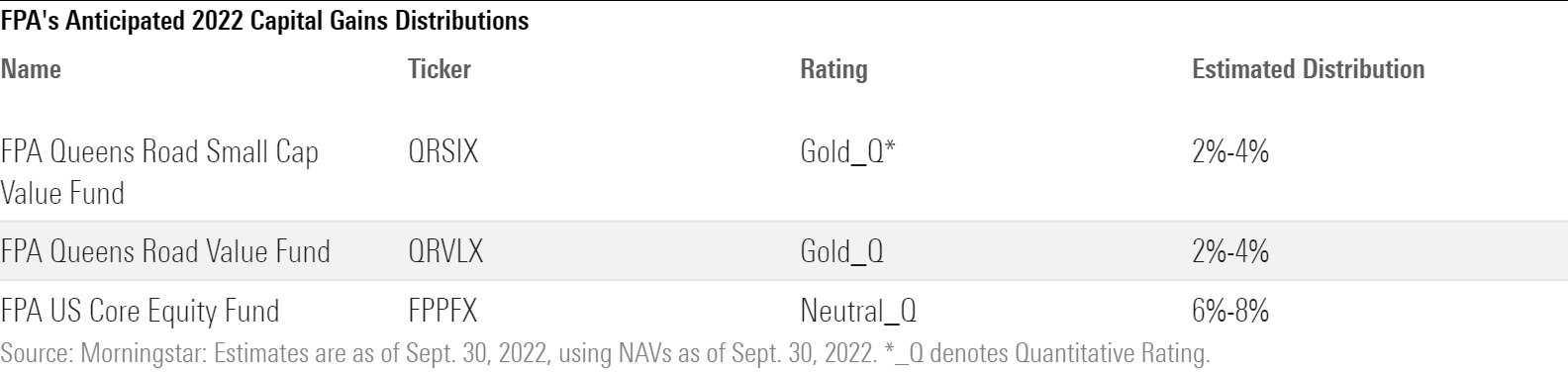

Mutual Funds Etfs A Capital Gain Comparison

Morningstar Downgrades Fund Strategies From Goldman J P Morgan Vanguard Thinkadvisor

Morningstar Archives The Evidence Based Investor

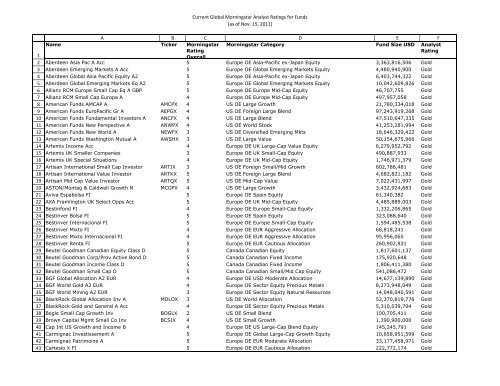

Current Global Morningstar Analyst Ratings For Funds As Of Nov 15

How To Read A Morningstar Report Pathfinder Planning

The Best Core Stock Funds For 2022 Morningstar

Vtmfx Vanguard Tax Managed Balanced Fund Admiral Shares Vanguard Advisors

Target Date Funds Vanguard Institutional

Archives For May 2020 Mutual Fund Observer

Morningstar Advisor April May 2010 69