does nc have sales tax on food

North Carolina Department of Revenue. Certain items have a 7-percent combined general rate and some items have a miscellaneous.

County Advocacy Hub North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

A seller that does not have a physical presence in North Carolina and does not have any other legal requirement to register in North Carolina for sales and use tax purposes but sells.

. 105-16413B gives the various exemptions and. County Sales Taxes. Counties and municipalities in North Carolina charge additional sales tax with rates between 2 and 275 for a maximum.

Each of these districts adds its levy to the. The local sales tax. Where can I go to learn more about why North Carolina does require sales tax on vitamins and supplements.

Twenty-three states and DC. However it is only subject to. But North Carolina does charge the 2 or 225 percent local sales tax.

Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Depending on local municipalities the total tax rate can be as high as 75. Lowest Effective Sales Tax Rate.

Treat either candy or soda differently than groceries. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being. At a total sales tax rate of 675 the total cost is 37363 2363 sales tax.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The State of North Carolina charges a sales tax rate of 475. What transactions are generally subject to sales tax in North Carolina.

As of 2014 there were 1012 taxing districts in North Carolina including counties cities and limited meal tax levies. Highest Effective Sales Tax Rate. North Carolina Sales Tax.

Prescription Drugs are exempt from the North Carolina sales tax. 35 rows Sales and Use Tax Rates Effective October 1 2020 Skip to main. County and local taxes in most areas.

To learn more see a full. Exceptions include localities in Arizona Colorado Georgia Louisiana North Carolina and South Carolina where grocery food purchases are fully or partially exempt at the. The North Carolina NC state sales tax rate is currently 475.

North Carolinas general state sales tax rate is 475 percent. The North Carolina NC state sales tax rate is currently 475. This page describes the taxability of.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Eleven of the states that exempt groceries from their sales tax base include both candy and. We include these in their state sales.

Statewide North Carolina Sales Tax Rate. Make Your Money Work A number of categories of goods also have different sales tax rates.

/cdn.vox-cdn.com/uploads/chorus_image/image/58347465/shutterstock_100280078.0.jpg)

Mexico And Hungary Tried Junk Food Taxes And They Seem To Be Working Vox

How Are Groceries Candy And Soda Taxed In Your State

How To Register File Taxes Online In North Carolina

State Sales Tax Free Weekend Shopping Just Updated 2022

N C Answers What S The Cost Of Living In My County

![]()

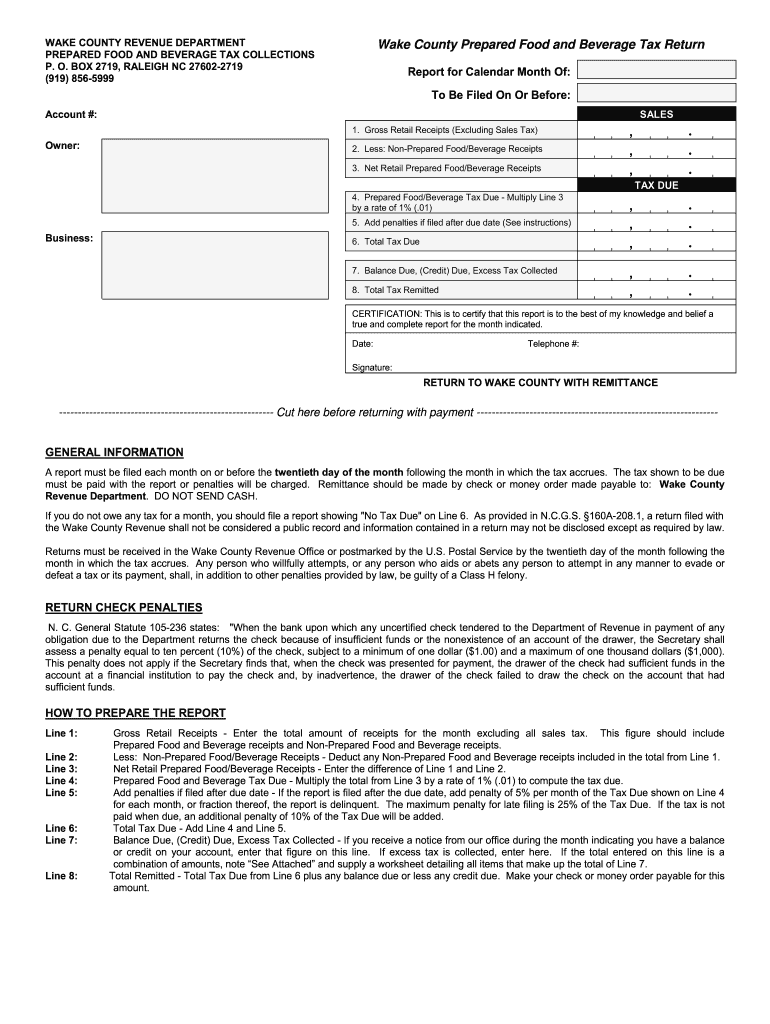

Prepared Food Beverage Tax Wake County Government

Wake County Prepared Food And Beverage Tax Return Fill And Sign Printable Template Online Us Legal Forms

States With The Highest Lowest Tax Rates

General Sales Taxes And Gross Receipts Taxes Urban Institute

New York City Sales Tax Rate And Calculator 2021 Wise

4 Ways To Calculate Sales Tax Wikihow

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Is Shipping Taxable In North Carolina Taxjar

North Carolina Sales Tax Small Business Guide Truic

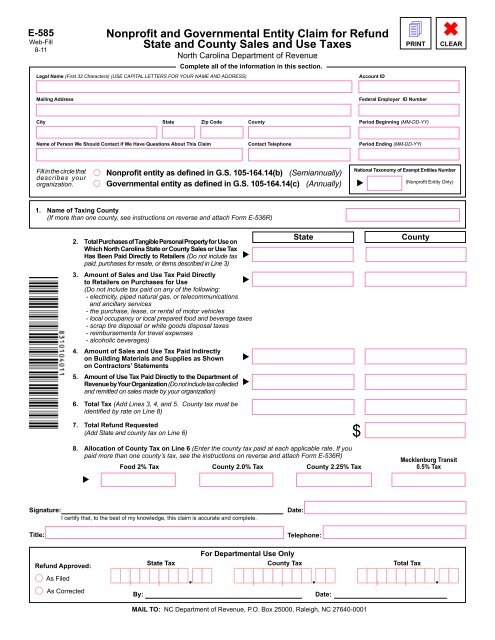

E585 Revised 12 03 Nc Department Of Revenue

Nc Appeals Court Rules Tax Avoiding Food Lion Owes Wcti

Kansas Gov Laura Kelly And Gop Challenger Derek Schmidt Both Propose Cutting The Sales Tax On Groceries Kcur 89 3 Npr In Kansas City

North Carolina Sales Tax Rate Rates Calculator Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities